IN THE NEWS

This quarter, we broke a record—but that’s not the part I’m most proud of. KITS.COM (TSX:KITS) we delivered $49.6M in revenue, our 11th consecutive quarter of positive EBITDA, and added over 111,000 new customers. But here’s what really matters: more people are discovering a better way to do eyecare—affordable, online, and built around them. One customer told us she never thought she’d trust buying glasses online. Now she’s sent five friends our way. When we started KITS, people said, “You can’t scale quality eyecare online.” Now? We’re doing it every day, across North America as the fastest growing company in the category. Thanks to our team and our customers for proving what’s possible.

Eyewa Celebrates 200 Stores Across the GCC – and We’re Just Getting Started 🔥 We are proud to announce a major milestone in Eyewa’s journey: the opening of our 200th retail store. Since launching our first store in 2020, Eyewa has rapidly expanded across Saudi Arabia, UAE, Kuwait, Bahrain, Oman, and Qatar, establishing ourselves as the region’s leading homegrown eyewear brand. Our most recent opening at Villaggio Mall, Qatar, marks not only our 200th location, but also the 42nd store opened in 2025 alone, a clear reflection of our continued growth and ambitious vision. Built in the region, for the region, Eyewa is committed to delivering high-quality eyewear, cutting-edge optical technology, and a customer-first, omnichannel experience that redefines how people shop for and experience eyewear in the Middle East. 🎙️ Co-founder Abdullah AlRugaib shared: “This is a huge moment for Eyewa and our entire team. We’ve built something truly special in just a few years, and we’re not slowing down. 2025 has already been transformative - just wait for what’s coming in 2026.” Here’s to the next chapter in our journey. Thank you to our teams, customers, and partners for making this milestone possible. VIEW ARTICLE

- Kits Eyecare Ltd. (TSX: KITS ) ("KITS" or the "Company") a leading vertically integrated eyecare provider, today unveils the beta launch of OpticianAI, the company's proprietary artificial intelligence platform designed to deliver a seamless and personalized way to shop for vision care. The breakthrough technology represents a major leap forward in combining digital innovation with optical expertise. With OpticianAI, KITS delivers the world's most experienced optician yet, available anywhere, anytime. OpticianAI is trained on over a million transactions and powered by real customer interactions, enabling it to guide users through a seamless frame selection process across more than 5,000 styles in minutes. From fit to function, style to prescription, OpticianAI delivers personalized guidance, revolutionizing how people shop for glasses and contacts. OpticianAI's technology's core engine combines AI-driven insights using customers' prescription, pupillary distance (PD), unique facial features and style to deliver recommendations personalized for their desires. The current beta launch of OpticianAI is being rolled out gradually to the company's customer traffic, enabling rapid iteration through real-time feedback and usage data. This launch marks the first step toward a future of agentic opticians, where OpticianAI powers fully integrated, end-to-end eyecare experiences. "We are once again leading the category in innovation and continuing our mission to make eyecare easy," said Roger Hardy, Co-Founder and CEO of KITS. "We've taken insights from over a million customer journeys and distilled them into a technology that offers unmatched personalization. As the world moves away from search towards active agents who seek out premium services KITS will once again be leading and be ready." OpticianAI is not just smart, the technology is intuitive and interactive. Key features of OpticianAI include: Selfie Fit Scan: Simply take a selfie to generate frame suggestions tailored to customers' facial features, skin tone, and personal style. PD and Facial Feature Detection: Real-time facial scanning calculates critical optical measurements and facial measurements for tailored frame size suggestions. Visual Match Tool: Upload a picture of any frame, whether a favorite shape, or a celebrity wearing the latest style and allow OpticianAI to identify the closest available options. Lens Guide: Upload a prescription to receive instant lens recommendation based on Rx parameters. Voice Interaction: Have natural conversations with OpticianAI. Customers can ask OpticianAI for recommendations, save favorites, or receive help interpreting prescriptions. Dual Try-On Experience: View two frames side-by-side using virtual try-on technology to compare style and fit. Smarter vision starts here. Try OpticianAI today and claim your first pair of prescription glasses free at https://www.kits.ca/optician-ai . VIEW ARTICLE

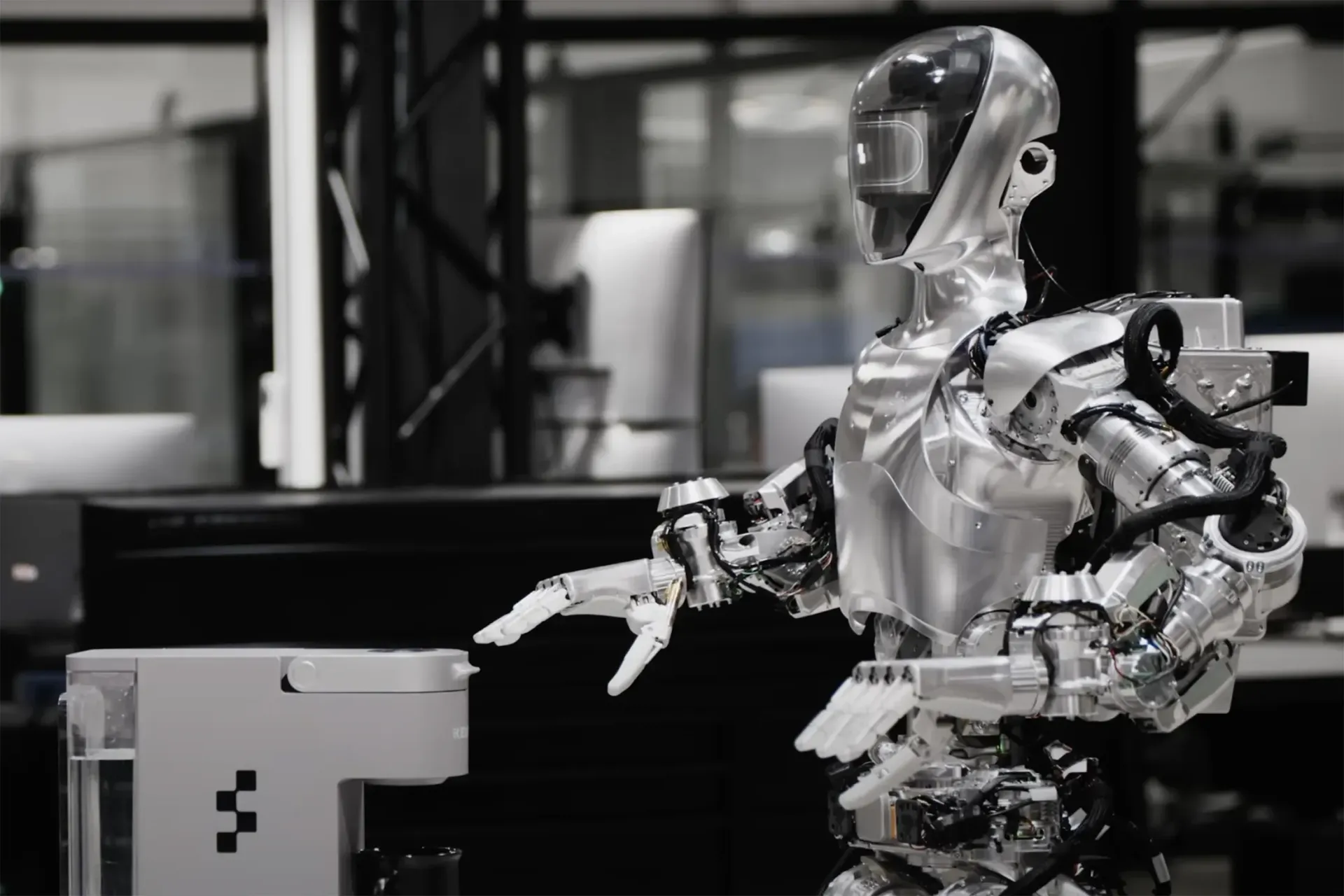

Figure AI, a robotics startup backed by Jeff Bezos and Hardy Capital, is reportedly in talks to raise $1.5 billion in a new Series C funding round, which would value the company at $39.5 billion. This eye‑catching valuation marks a dramatic escalation from its prior $2.6 billion post–Series B mark and underscores soaring investor expectations for AI‑powered humanoid robotics techmeme.com . Despite limited revenue and production scale, Figure has already secured BMW as a client for prototype testing at its manufacturing facility wsj.com+2hardycapital.com+2 . With a bold ambition to deploy over 200,000 humanoid units by 2029, the company embodies the cutting edge of automation—making it one of the most talked‑about Valuation‑hyped startups in Silicon Valley and a standout in the AI‑robotics investment landscape VIEW ARTICLE

Roger Hardy was named to Vancouver Magazine’s Power 50 list, recognizing him as one of the city’s most influential business leaders. The honor celebrated his entrepreneurial legacy, impact on the Canadian tech and consumer sectors, and ongoing contributions to the Vancouver business community. VIEW ARTICLE

Eyewa, the Middle Eastern eyewear disruptor, secured $100M in a Series C funding round to accelerate growth across the region. Hardy Capital’s continued support reflected its long-term commitment to building global leaders in vision care. Helping consumers find the perfect glasses is a booming global business, spawning giants like Warby Parker in the U.S. and Lenskart in India. In the Middle East, this market is producing its own rising powerhouse: Eyewa . Eyewa, based in Dubai and Riyadh, sells a wide range of eyewear products, including prescription glasses, sunglasses, blue light glasses, and contact lenses, through a direct-to-consumer (DTC) e-commerce and retail platform across five Middle East markets. Now the company has raised a $100 million Series C round. The round, led by global growth investor General Atlantic, brings Eyewa’s total funding to $130 million since its 2017 launch. VIEW ARTICLE

KITS launched its “Seeing is Believing” campaign, highlighting the transformative impact of accessible vision care. The initiative focused on building consumer trust, delivering innovation in eyewear, and reinforcing the brand’s mission of democratizing eye health. The co-founder and chief operating officer of a company with a market cap of over $200 million is pounding away on a keypad by a warehouse door outside of Vancouver’s Broadway Tech Centre in the middle of an absolute downpour. The code that Joseph Thompson is trying to jam into the system isn’t working. After a dozen apologies and a quick phone call, we’re inside. “You changed the code on me!” Thompson says playfully to operations manager Craig Culpan. “You can never be too careful,” says Culpan, a former member of the Canadian national rugby team, through a thick New Zealand accent. VIEW ARTICLE

Shares in Vancouver-based KITS Eyecare Ltd. (TSX:KITS) popped more than nine per cent today (May 8) following a first-quarter earnings report that impressed investors as it showed that the company had returned to profitability, on a record $34.8 million in quarterly revenue. The eyeglasses and contact lens seller's revenue rose 26 per cent, from $27.7 million in the same quarter last year. KITS, which primarily sells eyewear online, generated about $64,000 in net income, or profit, in the three months ended March 31, up from a $1.02 million loss in the same quarter one year ago, according to the report. "We started 2024 with another record quarter, achieving an annual revenue run-rate of nearly $140 million while achieving our sixth straight quarter of adjusted EBITDA-positive (earnings before interest, taxes, depreciation and amortization) growth," said Roger Hardy, co-founder and CEO of KITS. "We also maintained strict cost discipline throughout the quarter as we saw our operating expenses as a percentage of revenue decline across the board. With uncertainty throughout the broader consumer environment, our offering continued to cut through the economic and competitor noise, with more and more customers choosing KITS." VIEW ARTICLE

Vancouver entrepreneur Roger Hardy is one of the many ultra-rich technology investors backing the humanoid robot venture Figure AI. “I put over US$3 million into this deal,” Hardy told BIV. Bloomberg first reported that Amazon.com founder Jeff Bezos and large technology companies, such as Nvidia (Nasdaq:NVDA), had pumped approximately US$675 million into the new venture, in a funding round that valued the company at about US$2 billion. Others financing Figure AI include ChatGPT-maker OpenAI, and its main investor, Microsoft Corp. (Nasdaq:MSFT). LG Innotek, Parkway Venture Capital and Align Ventures are other investors backing the project. Hardy built Coastal Contacts Inc. into an online eyewear behemoth and sold the company to French lensmaker Essilor International for $430 million in 2014. VIEW ARTICLE

Roger Hardy was named one of BIV’s BC 500 Living Legends, a recognition honoring influential business leaders shaping British Columbia’s economy. The accolade reflected Hardy’s entrepreneurial track record and lasting impact across multiple industries, from e-commerce to vision care. BC500 features business leaders who have a notable impact on B.C.'s communities, industries and economy. They are visionaries, innovators and trailblazers. They embody the values of modern leadership: engagement, trust, corporate citizenship, inclusion and innovation. Some of them are household names; some of them are well known within their industries. All of them influence life and business in British Columbia. Living Legends: 13 individuals who have left their mark on British Columbia's economy. VIEW ARTICLE

Sonder , the hospitality startup backed by Hardy Capital , announced plans to go public through a $2.2 billion SPAC merger. The deal underscored Sonder’s rapid growth in reimagining hotel and apartment stays and reflected Hardy Capital’s role in backing transformative consumer experiences. VIEW ARTICLE

KITS Eyecare successfully completed its IPO on the Toronto Stock Exchange, marking a major milestone for Hardy Capital. The listing positioned KITS as a fast-growing disruptor in vision care, expanding its reach and demonstrating investor appetite for direct-to-consumer healthcare solutions. VIEW ARTICLE

Cymax Group , one of Hardy Capital’s notable investments, announced it had engaged RBC and TD to lead its planned IPO. The move represented a significant step toward scaling its online furniture and logistics business, while also signaling investor confidence in the accelerating e-commerce sector. VIEW ARTICLE

Foodee , a Hardy Capital portfolio company, announced its acquisition of Chewse , expanding its footprint into the San Francisco Bay Area. The deal strengthened Foodee’s ability to provide individually packaged, locally sourced meals for workplaces, positioning it well in a post-pandemic environment where safety and customization became top priorities. VIEW ARTICLE

Los Angeles dining was spotlighted in a feature on the city’s top 16 hottest restaurants. Hardy Capital–backed food ventures like Foodee gained visibility in this competitive market, underscoring the company’s reach into vibrant culinary hubs and its role in connecting businesses with trendsetting dining experiences. VIEW ARTICLE

Italian eyewear giant Safilo Group acquired a majority stake in Privé Revaux , marking a significant exit milestone for Hardy Capital. The deal reflected the brand’s meteoric rise in just a few years and demonstrated how celebrity-backed, direct-to-consumer models could scale globally and attract major strategic buyers. VIEW ARTICLE

Ca nalyst , a Vancouver-based startup offering equity research for capital markets, has closed a $20 million Series B. This brings Canalyst’s total funding to $28 million. The round was led by an undisclosed investor, and received additional commitments from ScaleUP Ventures and existing investors such as Vanedge Capital . The startup said the new capital will be spent on recruiting new talent in the areas of product enhancements and client service. Canalyst , a financial data and analytics platform, was featured for its ability to deliver clean, structured data and fundamental models to institutional investors. Backed by Hardy Capital, Canalyst became an essential tool for equity research, empowering analysts and asset managers with efficient, accurate insights. VIEW ARTICLE

Montreal-founded Sonder raises $225-million in financing, plans to open second headquarters in Canada. Sonder , a Canadian hospitality startup offering apartment-style accommodations with hotel-like services, achieved unicorn status with a valuation surpassing $1B. The milestone highlighted Hardy Capital’s involvement in backing transformative companies redefining traditional industries, in this case, blending real estate with hospitality innovation. VIEW ARTICLE

VANCOUVER, April 24, 2019 /CNW/ - Hardy Capital , a Canadian investment firm, announced today that it has completed the acquisition of LD Vision Group . LD Vision Group is North America's second largest independent direct retailer in eyecare. Powered by a proprietary end-to-end technology platform, LD Vision Group manages a family of brands that has delivered 2.7 million orders to more than 1.1 million customers. In 2018, the company generated approximately $50 million in revenues. Roger Hardy, CEO of Hardy Capital, previously founded the pioneering brand in omnichannel eyecare, Coastal.com. Coastal.com, owner of Clearly.ca and Lensway.se, grew steadily to over $1 billion in aggregate eyewear sales across 120 countries and was listed on the NASDAQ before being acquired by Essilor in 2014 for $450 million. Mr. Hardy is joined by Sabrina Liak, who was previously with Goldman Sachs Investment Partners, and Joseph Thompson, who was previously with Amazon and Procter & Gamble. "More than 70 per cent of North American adults have corrective vision needs, yet the eyecare industry continues to be plagued by high costs, low convenience, and inconsistent customer service," said Mr. Hardy. "Arshil Abdulla, Fayaz Abdulla, and Sean Mitha are leaders in North America in technology, automation, and customer service in the category. We're thrilled to be partnering with them to build a new platform for customers." Arshil Abdulla, founder and CEO of LD Vision Group, remarked, "We are excited to take this next step in the company's journey. We believe the optical market is preparing for a shift that will reshape the industry and partnering with the Hardy Capital team prepares us for this large and growing secular opportunity." Hardy Capital expects to announce broader expansion plans into the eyecare industry in the months ahead. The purchase of LD Vision Group marks the second investment in the eyecare category by the Hardy Capital team. In 2018, the team made a seed-stage investment in millennial hypergrowth brand, Privé Revaux. Canaccord Genuity Petsky Prunier, with a team led by John Fang, served as the exclusive financial advisor to LD Vision Group in this transaction. VIEW ARTICLE

Forbes profiled Privé Revaux Eyewear, highlighting its strong sales growth, brand collaborations, and unique celebrity-driven marketing approach. The feature validated the company’s business model as both commercially viable and culturally resonant, reinforcing Hardy Capital’s investment strategy in lifestyle brands with viral appeal. VIEW ARTICLE

Variety Magazine spotlighted Privé Revaux, emphasizing the brand’s Hollywood ties and its ability to democratize luxury eyewear for the mass market. The coverage positioned the brand at the intersection of fashion, celebrity culture, and consumer disruption, reinforcing its rapid growth trajectory. VIEW ARTICLE

InStyle Magazine featured Privé Revaux Eyewear, celebrating its trendy, accessible sunglasses line co-founded with celebrity partners like Jamie Foxx, Hailee Steinfeld, and Ashley Benson. The coverage elevated the brand’s profile in the fashion space, showcasing how Hardy Capital–backed consumer companies were making waves in pop culture.

This article explored Hardy Capital’s philosophy on talent recruitment, highlighting the idea that exceptional hires often come from unconventional backgrounds or overlooked sources. By focusing on potential and adaptability, Hardy Capital demonstrated its commitment to building diverse, high-performing teams beyond traditional pipelines. VIEW ARTICLE